Types of International Money Transactions

We are all heavily depended on financial systems to fulfil our daily requirements such as withdrawing our salaries using an ATM, paying our utility or supermarket bills from credit cards, ordering food online or even sending money across the seas. But many of us have very little or no knowledge on how these transactions works. Financial systems are evolving over the time thanks to the latest technology introducing more new, convenient options for us to handle day to day payments.

What are International Money Transactions?

International money transactions refer to the transfer of funds between individuals or businesses located in different countries. These transactions involve the movement of money across borders to facilitate various purposes such as trade, investment, remittances, or personal transfers.

International money transactions typically involve banks, financial institutions, or specialized money transfer companies that facilitate the transfer of funds across borders. These entities ensure compliance with regulatory requirements, facilitate currency conversion, and provide the necessary infrastructure to process and settle these transactions securely.

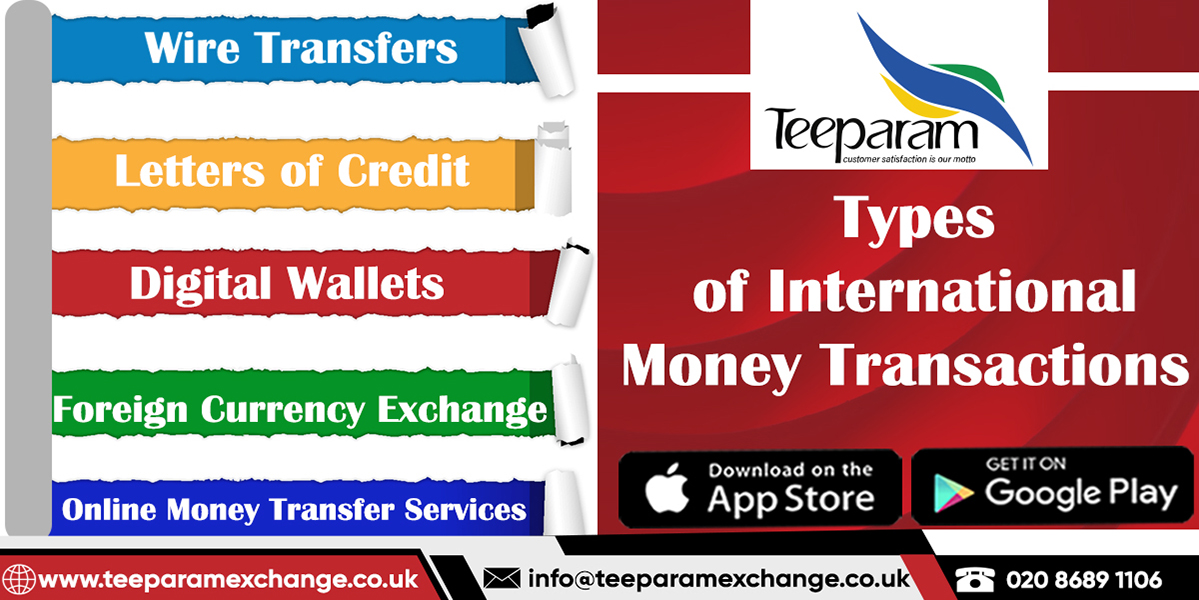

Types of International Money Transactions

International money transactions can take various forms.

Traditional Bank Transfers

• Wire Transfers

Banks offer wire transfer services to send money internationally. Customers can initiate wire transfers by providing the recipient's bank account details and the desired amount. Banks ensure the secure transfer of funds across borders, and the recipient's bank credits the amount to their account.

• Foreign Currency Exchange

Banks provide foreign currency exchange services to facilitate international transactions. Customers can exchange their local currency for the currency of the destination country. Banks may offer competitive exchange rates and charge a fee or commission for the service.

• Letters of Credit

Letters of credit are widely used in international trade. Banks issue letters of credit on behalf of importers, guaranteeing payment to exporters upon meeting specified conditions. This mitigates the risk for both parties and ensures smooth international transactions.

• Bank Drafts

Bank drafts, also known as cashier's checks or banker's drafts, are secure payment instruments issued by banks. Customers can obtain bank drafts in a foreign currency, which can be sent to the recipient who can then deposit it into their bank account. Bank drafts provide a reliable means of transferring funds internationally.

• International Bank Transfers

Banks enable customers to transfer funds directly between their own bank accounts located in different countries. This service allows individuals or businesses to manage their international finances efficiently and securely, such as transferring funds between personal accounts or funding international business operations.

• Trade Finance

Banks offer trade finance services to facilitate international trade transactions. These services can include providing letters of credit, export financing, import financing, and documentary collections. Trade finance helps businesses manage the financial aspects of international trade and reduce risks.

Digital Money Transactions

Online platforms have revolutionized international money transactions, offering convenient and efficient ways to transfer funds across borders.

• Online Money Transfer Services

Most of the online money transfer services allow users to send and receive money internationally. These platforms typically offer competitive exchange rates, low fees, and fast transfer times. Users can initiate transfers through websites or mobile apps, linking their bank accounts or using debit/credit cards as funding sources.

• Digital Wallets

Digital wallets enable users to make international money transactions securely using their smartphones. These wallets may support peer-to-peer transfers, online purchases, and in-store payments in different currencies.

• Mobile Money Transfers

Mobile money services, prevalent in many developing countries, allow users to send and receive money through mobile phones. Certain service providers enable users to transfer funds domestically and internationally, leveraging the widespread availability of mobile networks.

• Online Banking Transfers

Many banks provide online banking platforms that enable customers to initiate international money transfers conveniently. Through their online banking portals or mobile apps, users can add international payees, enter recipient details, and transfer funds between their accounts in different currencies.

• Peer-to-Peer (P2P) Lending and Crowdfunding

Online platforms for P2P lending and crowdfunding allow individuals or businesses to raise funds internationally. These platforms connect borrowers with lenders or investors from around the world, enabling cross-border financial transactions.

• Online Payment Gateways

E-commerce platforms and online marketplaces often integrate online payment gateways to process international transactions. These gateways provide secure and reliable payment processing, allowing buyers and sellers to conduct cross-border transactions easily.

Transaction Using Crypto Currency

Digital currencies, such as cryptocurrencies, have emerged as a unique form of international money transactions.

• Cryptocurrency Transfers

Cryptocurrencies like Bitcoin, Ethereum, and others allow users to send funds directly to recipients anywhere in the world, offering fast and secure borderless transfers.

• Cross-Border Remittances

Digital currencies provide a low-cost and efficient alternative for international remittances, enabling individuals to send money to family or friends in other countries.

• Initial Coin Offerings (ICOs)

ICOs allow startups or projects to raise funds globally by issuing digital tokens or coins, attracting international investors.

• Trading and Speculation

Cryptocurrencies are traded globally on various exchanges, allowing investors to buy and sell digital assets across borders.

• Cross-Border Payments for Goods and Services

Businesses accepting cryptocurrencies as payment can receive international payments more easily, simplifying cross-border commerce.

• Decentralized Finance (DeFi)

DeFi platforms offer decentralized financial services globally, allowing users from different countries to engage in activities like lending and borrowing without intermediaries.

International money transactions encompass a range of methods and mechanisms that facilitate the movement of funds across borders.

These transactions serve various purposes, such as facilitating business transactions, enabling cross-border trade, supporting individuals and families through remittances, and simplifying travel and shopping experiences for tourists. Common types of international money transactions include cross-border wire transfers, foreign currency exchange, credit and debit card transactions, international checks, money orders, online payment systems, and remittances.

Each of these methods has its own advantages and considerations, such as speed, cost, convenience, and availability, which individuals and businesses should carefully evaluate when selecting the most suitable option for their specific needs. The evolving landscape of technology and financial services continues to shape and expand the possibilities for international money transactions, making it important for users to stay informed and adapt to the changing environment.